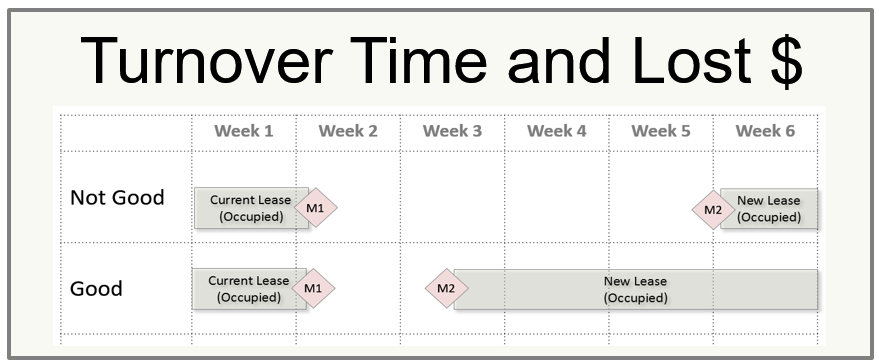

When rental properties are vacant, investors are losing money. Turnover is the work involved in getting a property ready for the next tenant, and turnover is important to real estate investment management. Can analytics be useful for minimizing this lost revenue?

The answer is yes! If your property management system enables you to extract key dates in the turnover process, you will have the means for understanding where time is lost and how to minimize the turnover time. Analytics can be used to create an improvement action plan.

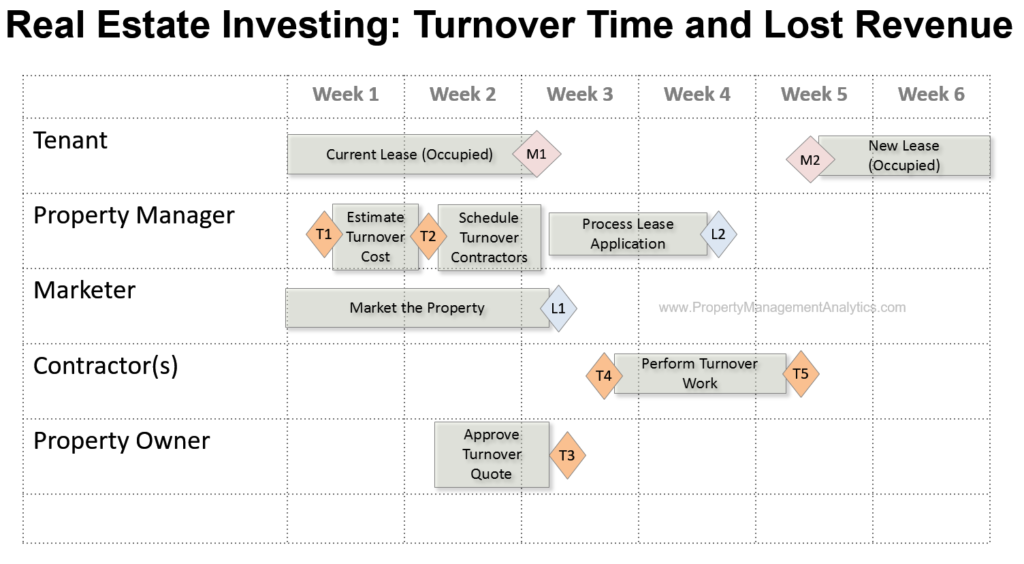

The diagram below shows a model for the vacant property turnover activities.

The key milestones are:

- T1: Property Manager conducts Pre-Moveout Walkthrough (normally 2 weeks before tenant vacates)

- T2: Property Manager provides turnover quote to Owner for approval

- T3: Owner approves the quote

- T4: Turnover crew begins work on turnover (have to wait for tenant to move out)

- T5: Turnover crew completes turnover work. Inspection is complete.

- L1: Leasing Agent receives application from prospective tenant

- L2: Property Manager completes all steps of the application approval process

- M1: Current tenant vacates property (end of revenue stream)

- M2: New tenant occupies property (and new revenue stream begins)

Big gaps between M1 and M2 can take the fun out of real estate investment management.

There is a nice article and checklist here in this post on Bigger Pockets titled “The Landlord’s Ultimate 34-Step Property Management Checklist” by Elizabeth Faircloth. The scenario described in the article is somewhat different from my example above.

If your property management system(s) can provide you the dates for the above milestones, this would be ripe area for applying analytics to improve a process, reduce turnover cycle time, and optimize the revenue opportunity. Unfortunately, because of the way some systems are modeled, it is not easy to piece together the history of events in the chain.

Later I will post a demo showing how such dates can be utilized understand process strengths and weaknesses and to create an action plan. I think companies and individual investors involved in real estate investment management will find it useful.

Please share your own experiences with managing turnover duration in the comments below.