A large investment company I am working with has the strategy to build “a platform for add-on, accretive acquisitions.” This company is strategically acquiring well-managed property management companies, and incorporating them into its growing portfolio. While it is very successful, its data management capability limits the speed at which it can increase the value of its property acquisitions.

Property Acquisitions: Paths to Value Creation

An acquisition of another property management company is not done only for cashflow; there are other paths to value creation, such as:

• Access to a new market

• Realizing economies of scale by increasing the number of units managed

• Lower costs by eliminating waste and duplication across properties

• Better margins through process improvements

• Consistent results across portfolio by applying industry best practices

Data Analysis, a Key Competency

So, how is all this relevant to a blog post about property management analytics? It is relevant because data analysis is a core competency of these firms. All well-managed property acquisitions firm are systems-oriented. They have processes for evaluating acquisition opportunities, they have processes for doing the financial analysis, they have processes for on-boarding the new company and its personnel, and they have well-defined processes for tracking the performance of each acquisition.

Such companies have defined the metrics and the ratios that are important for each stage, and they look at the data. However, there’s a bottleneck in this systematic acquisition process: the ability to analyze data quickly and broadly.

Excel Files Everywhere

These firms specializing in property acquisitions look at lots of data. Excel is the tool of choice. There can be as many as 100 Excel files generated for evaluating a set of opportunities. Many files are identical except for differences in parameters that represent different scenarios. When they perform due diligence using operational data, they export reports into Excel and then manually pull data into their analysis models. This is very labor-intensive, and also a very slow process.

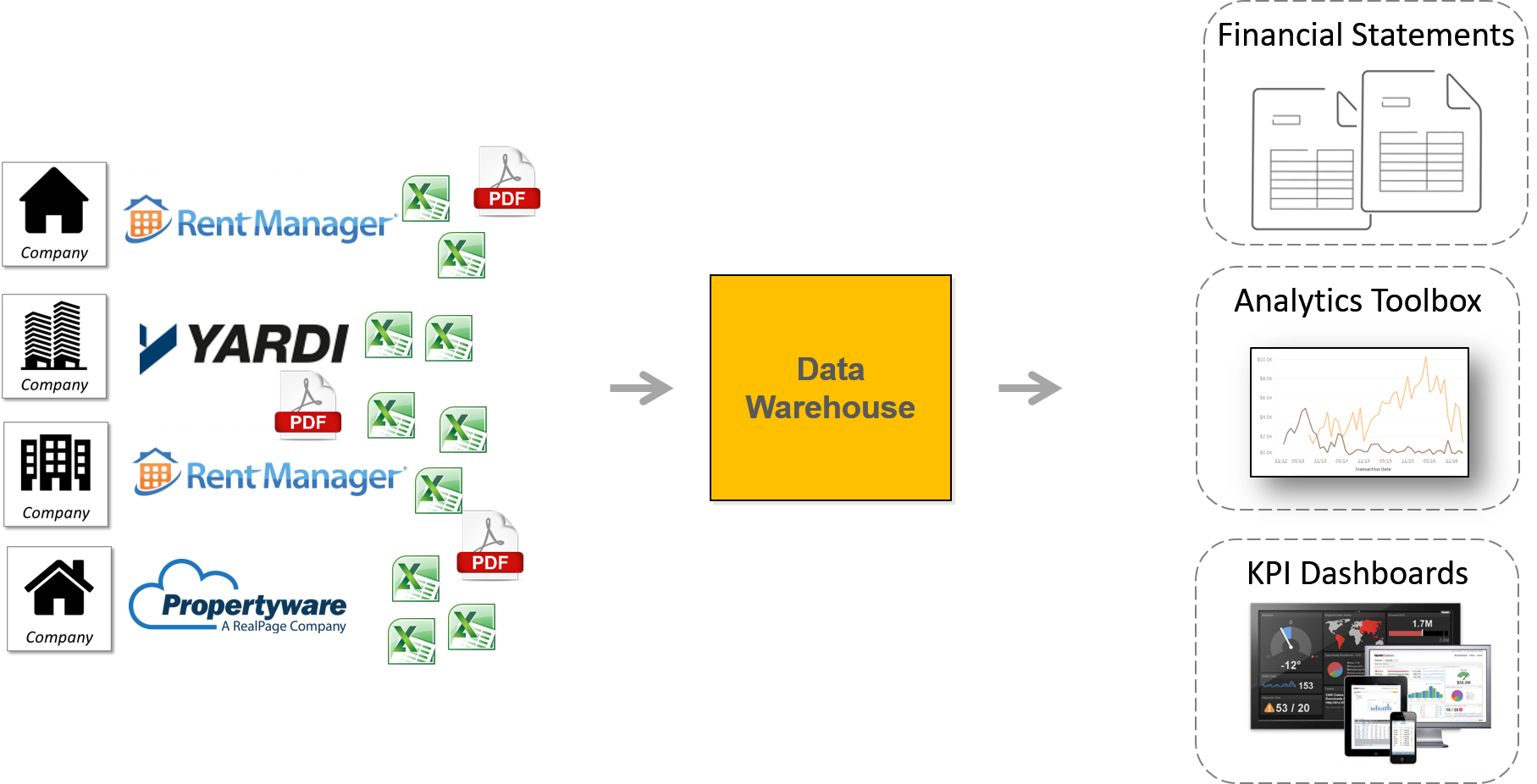

After the acquisition, when consolidated financial statements have to be produced, they are faced with the same manual, slow process. In some cases, it takes more than 30 days after month-end to close the books and produce statements. Such hard work leaves little time for strategic evaluation of the operational data, data mining or predictive modeling. The picture looks like this diagram:

Improving Data Management

If your acquisition company is inundated with Excel files and is facing challenges using data effectively, I recommend this video: Building Blocks of Analytics (video). The Analytics Architecture diagram shown in the video can be downloaded from here.

Data analysis throughput can be drastically improved by implementing a data management architecture like the one shown below. The Data Warehouse, or “Reporting Database”, is described in a separate blog post.